Wednesday, December 29, 2010

Update: Inverted Block Rates in Montana

The Montana PSC denied all Motions in the case, yesterday Dec. 28th, 2010. This means, for better or worse, the Montana PSC original order implementing decoupling will stand, until the whole concept is outlawed by the Montana Legislature.

Tuesday, December 28, 2010

FERC denies Grasslands proposal for their Wind Spirit Project

Grasslands Renewable Energy is trying to build the Wind Spirit Project in eastern Montana that would collect 3000 MW of renewable energy. A first step, was getting the FERC to approve their funding methodology which would have certain subsidiaries of Grassland's parent company, a Spanish industrial conglomerate, owning wind projects along the collector system. The project is certainly innovate, but the FERC issued an Order recently denying their proposal would "improperly grant an undue preference to certain transmission customers, and as such is inconsistent with section 205 of the Federal Power Act (FPA) and the Commission's open access principle".

There is a temptation to draw parallels to other Transmission projects in the state, but I don't know what the lesson is, other than developing transmission is difficult and the FERC is not just rubber stamping stuff.

There is a temptation to draw parallels to other Transmission projects in the state, but I don't know what the lesson is, other than developing transmission is difficult and the FERC is not just rubber stamping stuff.

Credit where Credit is due

This blog has made a point of targeting one soon to be member of the Montana Public Service Commission, Travis Kaulla, for accuracy. I believe that this was a factor largely of Travis being one of the few Commissioners willing to actually put ideas on energy policy out into the public sphere, and also the fact that he was working full time and trying to run a campaign (which made it easier to miss details...).

In that context, I did want to commend Travis on his recent blog post, of which I believe to be both an accurate portrayal of the MATL situation and a very apt summary of the political, legal, and economic realities of the project.

Keep it up!

In that context, I did want to commend Travis on his recent blog post, of which I believe to be both an accurate portrayal of the MATL situation and a very apt summary of the political, legal, and economic realities of the project.

Keep it up!

Inverted Block Rates and Decoupling Dead in Montana?

On December 20th, the Montana Consumer Council, Human Resources Council District XI/Natural Resource Defense Counsel (HR/NRDC) and NorthWestern Energy filed a joint motion asking the MT PSC to reverse the Commission's previous decision to implement inverted block rates and decoupling.

The parties agreement on this outcome can be interpreted in only one way: The MT PSC really messed up.

The fact that both supporters of the new rate design (NWE and HR/NRDC) and opponents (MCC) have decided that the MT PSC's final rule on the matter is so flawed that it is better to just junk it, demonstrates how fundamentally flawed the final order is.

The parties highlight a number of specific problems in their individual motions that include the MT PSC's lowering of NWE's rate of return for certain energy efficiency investments, not including natural gas, and the use of weather normalization.

It is truly disappointing that the MT PSC was not able to work with the parties, including the MCC which did not oppose the new rate designs on principal, to get a pilot proposal in place that would work.

It is after all, not a novel idea. All three regulated electrical utilities in Idaho have similar rate structures, the Montana Power Company used to use these rates, and across the United States they are known to produce increased energy efficiency investment.

I understand that the Motions will be considered by the new Montana PSC in January. One outcome, which would be very unfortunate, is to not honor the joint request of the parties and leave the fundamentally flawed order in place. This would result in a failed program, that would set-back efforts to implement these common sense rate structures for years.

Though i note that one Montana Legislator has requested a bill draft that would "Limiting a public utility's ability to implement inverted block rates". Thank freshman Jason Priest for his help in making it harder, if not impossible, to apply basic cause causation principals to our electrical rates.

The parties agreement on this outcome can be interpreted in only one way: The MT PSC really messed up.

The fact that both supporters of the new rate design (NWE and HR/NRDC) and opponents (MCC) have decided that the MT PSC's final rule on the matter is so flawed that it is better to just junk it, demonstrates how fundamentally flawed the final order is.

The parties highlight a number of specific problems in their individual motions that include the MT PSC's lowering of NWE's rate of return for certain energy efficiency investments, not including natural gas, and the use of weather normalization.

It is truly disappointing that the MT PSC was not able to work with the parties, including the MCC which did not oppose the new rate designs on principal, to get a pilot proposal in place that would work.

It is after all, not a novel idea. All three regulated electrical utilities in Idaho have similar rate structures, the Montana Power Company used to use these rates, and across the United States they are known to produce increased energy efficiency investment.

I understand that the Motions will be considered by the new Montana PSC in January. One outcome, which would be very unfortunate, is to not honor the joint request of the parties and leave the fundamentally flawed order in place. This would result in a failed program, that would set-back efforts to implement these common sense rate structures for years.

Though i note that one Montana Legislator has requested a bill draft that would "Limiting a public utility's ability to implement inverted block rates". Thank freshman Jason Priest for his help in making it harder, if not impossible, to apply basic cause causation principals to our electrical rates.

Tuesday, November 30, 2010

Inverted Block Rates & Decoupling, approved

I just had a chance to watch the MT PSC's meeting from last week. It was a long and complicated meeting, but here is the outcome as I heard it:

A previous post on the topic, implied that the splits for inverted block rate groups would apply to all consumption by the individual. Based on what i heard, this is not the case. All customer would get the benefit of the the reduced rate for their first 350 kWh.

Please, by all means, comment if i got the decision of the meeting wrong. I had been waiting for Mike Dennison, Charles S. Johnson or frankly anybody to write up the meeting, but alas...

- Decoupling is approved on the Electric Side only

- Inverted Block Rates are approved for both electricity and natural gas

A previous post on the topic, implied that the splits for inverted block rate groups would apply to all consumption by the individual. Based on what i heard, this is not the case. All customer would get the benefit of the the reduced rate for their first 350 kWh.

Please, by all means, comment if i got the decision of the meeting wrong. I had been waiting for Mike Dennison, Charles S. Johnson or frankly anybody to write up the meeting, but alas...

Monday, November 22, 2010

Inverted Block Rates & Decoupling, MT PSC meeting Tomorrow @ 1:00

The MT PSC has scheduled a work session on NorthWestern Energy's general rate case for tomorrow at 1:00 pm. The, ah, lame duck PSC has a chance to approve some very significant policy proposals, and in my opinion, steer Montana energy policy in a positive direction. The PSC streams live, with a link on their main page.

In that context I like the spin that Senator elect Caffero and Human Resources Council District XI executive director Jim Morton, put on it in today's Missoulian.

"Furthermore, the two measures would create a more customer-focused utility. NorthWestern Energy is poised to move from a simple energy utility trying to sell as much power as possible to a full-service energy company focused on providing its customers a range of products, from electricity to energy efficiency.

Montanans can have a utility that doesn't have to sell us a kilowatt-hour of electricity rather than an equal amount of efficiency to recover its costs and turn a profit. We can adopt a more rational energy policy that protects our health and environment and lowers our energy bills."

In that context I like the spin that Senator elect Caffero and Human Resources Council District XI executive director Jim Morton, put on it in today's Missoulian.

"Furthermore, the two measures would create a more customer-focused utility. NorthWestern Energy is poised to move from a simple energy utility trying to sell as much power as possible to a full-service energy company focused on providing its customers a range of products, from electricity to energy efficiency.

Montanans can have a utility that doesn't have to sell us a kilowatt-hour of electricity rather than an equal amount of efficiency to recover its costs and turn a profit. We can adopt a more rational energy policy that protects our health and environment and lowers our energy bills."

Friday, November 19, 2010

SMG&T Dodges a bullet

I had previously posted about how SMG&T was having trouble with understanding its obligations upon reserving transmission (see the inaugural post). Yesterday the FERC resolved the situation (at least until NWMT appeals), in favor of SMG&T.

The FERC's decision is available here. FERC's rational is, and even in context of the topic, technical. Basically, NWMT did not have SMG&T execute the correct contract for the type of transmission service that they secured.

I am a little disappointed. SMG&T had held some valuable transmission capacity for a long-time, and the FERC's decision did not penalize them for not doing better due diligence. Gaelectric and Naturener, and other wind developers might have been able to get projects moving without the request in the way.

The FERC's decision is available here. FERC's rational is, and even in context of the topic, technical. Basically, NWMT did not have SMG&T execute the correct contract for the type of transmission service that they secured.

I am a little disappointed. SMG&T had held some valuable transmission capacity for a long-time, and the FERC's decision did not penalize them for not doing better due diligence. Gaelectric and Naturener, and other wind developers might have been able to get projects moving without the request in the way.

Wednesday, November 17, 2010

Some Energy News, and a taste of the new PSC majority

- I watched with interest the exchange between Commissioner Molnar and PSC staff over NorthWestern Energy's request for interim rate relief on Mill Creek. The exchange starts 28 minutes into the PSC's stream which is archived here. Commissioner Molnar's comments, and his vote against the request, demonstrate that he is opposed to NorthWestern Energy using the plant to meet their balancing needs. Permanent rates for the facility could be in jeopardy with a new PSC majority....

- Senator Tester has an Op-Ed out defending the MT RPS standard and discussing his role in its passing.

- The Great Falls Tribune offers Tim Gregori an opportunity to explain why public power is not dead, and in his continuing nepotism he cites his own work, and not that of actually successful public power (ie: Flathead Electric).

- Someone has filed an interconnection request for 125 MW of wind NE of Greycliff Montana in Sweet Grass County Montana.

Tuesday, November 9, 2010

PPL Protests NorthWestern Energy's classification of Montana's Import Capacity

You would be excused for not knowing what a triannual market power study is, and how important it is to Montana consumers. At its most basic level, this is the analysis completed by each utility and wholesale power provider to demonstrate to the Federal Energy Regulatory Commission that they do not have monopoly power and should not have the price they sell power for be regulated by the FERC.

NorthWestern Energy filed their triannual market power study in June of this year. Given that NorthWestern Energy owns very little generation assets the exercise is more of a formality. But PPL (Pennsylvania Power and Light, who acquired the majority of Montana's Powers Hydro after deregulation) disagrees in some assumptions of the study, and has filed a limited protest of NorthWestern Energy's study.

The third page of the protest demonstrates what PPL is after:

"Not completely scaling down the generation located in the NorthWestern BAA results in the SIL being understated for each of the four season. Because PPL Companies and other generators located in NorthWestern's BAA may rely on NorthWestern's SIL in their own market power analyses, NorthWestern's Revised SIL Study must provide an accurate accounting of the import capacity into the NorthWestern BAA. (p.3, emphasis added)"

A little interpretation is in order. First, SIL is Simultaneous Import Limits, and it expresses the amount of electricity that can be imported into Montana. PPL has a lot to be concerned about. All else constant, the lower the SIL value is, the more likely PPL the FERC is to believe that PPL has market power and regulate the price they sell energy for.

Of course, we have been here before, and I do not think that I stand alone in the Montana Energy community in thinking that PPL has monopoly power and has used it in the past to gouge Montana Consumers for millions. Hopefully this batch of Public Service Commissioners will be bold enough to get involved and protect rate payers.

NorthWestern Energy filed their triannual market power study in June of this year. Given that NorthWestern Energy owns very little generation assets the exercise is more of a formality. But PPL (Pennsylvania Power and Light, who acquired the majority of Montana's Powers Hydro after deregulation) disagrees in some assumptions of the study, and has filed a limited protest of NorthWestern Energy's study.

The third page of the protest demonstrates what PPL is after:

"Not completely scaling down the generation located in the NorthWestern BAA results in the SIL being understated for each of the four season. Because PPL Companies and other generators located in NorthWestern's BAA may rely on NorthWestern's SIL in their own market power analyses, NorthWestern's Revised SIL Study must provide an accurate accounting of the import capacity into the NorthWestern BAA. (p.3, emphasis added)"

A little interpretation is in order. First, SIL is Simultaneous Import Limits, and it expresses the amount of electricity that can be imported into Montana. PPL has a lot to be concerned about. All else constant, the lower the SIL value is, the more likely PPL the FERC is to believe that PPL has market power and regulate the price they sell energy for.

Of course, we have been here before, and I do not think that I stand alone in the Montana Energy community in thinking that PPL has monopoly power and has used it in the past to gouge Montana Consumers for millions. Hopefully this batch of Public Service Commissioners will be bold enough to get involved and protect rate payers.

Public Service Commissioners, standard for suspension

This post is not intended as an editorial for the Governor to take a specific action in regard to a specific commissioner (ex A, ex B). It is just an observation that the rules for removal of Public Service Commissioners differ than those of other elected offices, and may afford the Governor a right.

Montana Code Annotated, 69-1-113:

Removal or suspension of commissioner. If a commissioner fails to perform the commissioner's duties as provided in this title, the commissioner may be removed from office as provided by 45-7-401. Upon complaint made and good cause shown, the governor may suspend any commissioner, and if, in the governor's judgment the exigencies of the case require, the governor may appoint temporarily some competent person to perform the duties of the suspended commissioner during the period of the suspension.

I would be interested in the analysis of inquiring legal minds, and if any such precedent exists, but my read of the statute is that the Governor has the right to suspend a Commissioner.

Montana Code Annotated, 69-1-113:

Removal or suspension of commissioner. If a commissioner fails to perform the commissioner's duties as provided in this title, the commissioner may be removed from office as provided by 45-7-401. Upon complaint made and good cause shown, the governor may suspend any commissioner, and if, in the governor's judgment the exigencies of the case require, the governor may appoint temporarily some competent person to perform the duties of the suspended commissioner during the period of the suspension.

I would be interested in the analysis of inquiring legal minds, and if any such precedent exists, but my read of the statute is that the Governor has the right to suspend a Commissioner.

Friday, November 5, 2010

Electric City Customer to go to NorthWestern Energy?

On Tuesday, it was reported that the City of Great Falls is interested in getting out of the wholesale power business and asked NorthWestern Energy if they would consider acquiring their customers. NorthWestern Energy responded with excitement, and has sent a response letter requesting load data and contractual commitments. The Billings Gazette has a permanent archive of the story here. And the Great Falls Tribune editorialized today that restraint is needed on the Electric City's behalf.

A couple observations on the proposed transaction come to mind.

A couple observations on the proposed transaction come to mind.

- At the highest level, this seams like a good idea. There are certainly economies of scale in the wholesale power business, and the Electric City's current companions (SMG&T) have not figured those out.

- NorthWestern Energy should be interested, and could probably be persuaded to pay for the rights to these customers. Think some discount of their authorized rate of return x the quantity of expected annual sales.

- The deal is not insignificant, as Electric City has a total demand of about 250,000 MWh. This is about 5% of NorthWestern Energy's total load.

I look forward to folks posting observations on the deal, especially those of Mr. Kavulla.

BPA to extend Service to Alcoa

With the election press focus, I missed this important announcement from BPA. BPA will continue providing 320 MW of firm power to Alcoa for another year, at $34.60 MWh.

BPA extends service to Alcoa

Portland, Ore 10/29/2010. - The Bonneville Power Administration will meet Alcoa’s request to continue providing wholesale power to the company’s Intalco plant in Ferndale , Wash.

Alcoa had asked BPA to extend service in September, saying the power sale will allow the company a chance to continue operating and save about 500 jobs.

“We considered the request very carefully to make sure that, in addition to helping the plant continue operations, the power sale made good business sense for our other ratepayers,” said BPA Administrator Steve Wright. “It was important to assure that the net benefits from serving Alcoa exceeded the cost of service.”

Under the Northwest Power Act of 1980, certain electricity-intensive industries were allowed to buy wholesale power directly from BPA. These were primarily aluminum smelters, often referred to as direct-service industries. Today, Alcoa is the only smelter directly served by the agency. At one time, there were as many as 10.

BPA signed the current contract with Alcoa in December 2009, and the company began receiving power from BPA last May. The service period was limited by a decision handed down by the U.S. Court of Appeals for the Ninth Circuit. The Court ruled that non-obligatory contracts with direct-service industries must be consistent with sound business principles. In other words, the benefits to BPA of serving the direct-service industry must equal or exceed BPA's cost of serving the load during the period of service.

Following that ruling, BPA did an analysis called an equivalent-benefits test to determine if net benefits would flow to BPA and its ratepayers through a contract with Alcoa. The test showed net benefits but, given the volatility of the economy, could only guarantee them through the coming May. BPA left the door open for a longer service period if a subsequent equivalent-benefits test showed the same results for extended periods.

Following Alcoa’s request for extending service, BPA conducted another stringent test of benefits, followed by a public comment period. Not only had the current service period produced positive net economic benefits, but the new analysis indicated that extending the Alcoa power sale for 12 months should continue to benefit BPA and its ratepayers.

“We believe this is a good outcome for Alcoa workers and BPA’s other ratepayers,” Wright said. “Whether it’s setting rates, managing our costs or providing service, we are well aware of the positive impact we can have on our regional economy.”

Based on the equivalent benefits analysis and a public comment period, BPA agreed to extend the initial period of service. In late October, the agency issued a final record of decision indicating that it will extend the service period of its Dec. 21, 2009, power block contract with Alcoa for 12 months, through May 26, 2012. Further extensions may be granted as long as BPA determines it would achieve equivalent benefits for the requested period.

BPA extends service to Alcoa

Decision could keep 500 jobs in region

Portland, Ore 10/29/2010. - The Bonneville Power Administration will meet Alcoa’s request to continue providing wholesale power to the company’s Intalco plant in Alcoa had asked BPA to extend service in September, saying the power sale will allow the company a chance to continue operating and save about 500 jobs.

“We considered the request very carefully to make sure that, in addition to helping the plant continue operations, the power sale made good business sense for our other ratepayers,” said BPA Administrator Steve Wright. “It was important to assure that the net benefits from serving Alcoa exceeded the cost of service.”

Under the Northwest Power Act of 1980, certain electricity-intensive industries were allowed to buy wholesale power directly from BPA. These were primarily aluminum smelters, often referred to as direct-service industries. Today, Alcoa is the only smelter directly served by the agency. At one time, there were as many as 10.

BPA signed the current contract with Alcoa in December 2009, and the company began receiving power from BPA last May. The service period was limited by a decision handed down by the U.S. Court of Appeals for the Ninth Circuit. The Court ruled that non-obligatory contracts with direct-service industries must be consistent with sound business principles. In other words, the benefits to BPA of serving the direct-service industry must equal or exceed BPA's cost of serving the load during the period of service.

Following that ruling, BPA did an analysis called an equivalent-benefits test to determine if net benefits would flow to BPA and its ratepayers through a contract with Alcoa. The test showed net benefits but, given the volatility of the economy, could only guarantee them through the coming May. BPA left the door open for a longer service period if a subsequent equivalent-benefits test showed the same results for extended periods.

Following Alcoa’s request for extending service, BPA conducted another stringent test of benefits, followed by a public comment period. Not only had the current service period produced positive net economic benefits, but the new analysis indicated that extending the Alcoa power sale for 12 months should continue to benefit BPA and its ratepayers.

“We believe this is a good outcome for Alcoa workers and BPA’s other ratepayers,” Wright said. “Whether it’s setting rates, managing our costs or providing service, we are well aware of the positive impact we can have on our regional economy.”

Based on the equivalent benefits analysis and a public comment period, BPA agreed to extend the initial period of service. In late October, the agency issued a final record of decision indicating that it will extend the service period of its Dec. 21, 2009, power block contract with Alcoa for 12 months, through May 26, 2012. Further extensions may be granted as long as BPA determines it would achieve equivalent benefits for the requested period.

Wednesday, November 3, 2010

Some regional energy election results

- Prop 23 failed overwhelmingly (61-38), which would have suspended California's 2006 Global Warming act. This act is driving for renewable energy growth in California and across the West.

- Initiative 7 passed in Idaho (57-43), which allows municipal electrical utilities to enter into long-term contracts for energy (profiled here on this blog).

- Both republicans (Kavulla & Gallagher) won their races for the Montana Public Service Commission, placing that party in control.

Any others?

Monday, November 1, 2010

Hines, Letter

Claudia Rapkoch, NorthWestern Energy's Director of Corporate Communications forwarded me the following letter late last Friday. I am hesitant to post it for three reasons that I will explain, but given my deep respect for Mr. Hines and his position I will honor the request.

First, the letter is not clear if the cost of Judith Gap that Mr. Hines reports "about $40" is inclusive of the cost of integration. This is important, as Mr. Brouwer's Op-ed that Mr. Hines is critical of, identified the $29 as just the energy cost. With integration, the price would be at the "about $40" level, which is this blog's opinion of the price.

Second, Mr. Hines does not provide a conclusive price for what new renewable energy will cost. Providing an average of bids is basically meaningless in describing future costs. One would expect, given that all bids are real, that the lowest cost bid would be the one selected by NorthWestern Energy. It is also likely that the high bid is probably for solar, which is unlikely to be built in Montana and would skew the price up. Given that NorthWestern Energy has just completed a Resource Procurment Plan that requires a detailed assessment of the cost of new renewables, i am curious as to why a more formal estimate for pricing was not provided (I suspect politics are afoot, and NWE's directors are aiming at the RPS).

Third, Mr. Hines claims that Mr. Brouwer's price for efficiency is wrong. I think that Mr. Brouwer and Mr. Hines are splitting hairs here, but it would be helpful to see some analysis from either party to support their estimate. Once again, Mr. Hines has a Resource Procurement Plan to reference. I would also note that the plan was delayed so NorthWestern Energy could complete a detailed study on the cost of energy efficiency.

Third Updated (11/3/2010), Here is the response i received from Mr. Brouwer which I have not verified, I have not received anything from Mr. Hines:

"The $4.80/MWh figure I used comes straight from testimony by Bill Thomas (NorthWestern Energy) in the recent PSC rate case (PDF page 8). I suspect the $12 figure they’re using is from a third party analysis of their DSM operations that they had done by Nexant in 2007. Unfortunately that report is three years old and doesn’t reflect the notable downward trend in DSM costs over the past few years."

First, the letter is not clear if the cost of Judith Gap that Mr. Hines reports "about $40" is inclusive of the cost of integration. This is important, as Mr. Brouwer's Op-ed that Mr. Hines is critical of, identified the $29 as just the energy cost. With integration, the price would be at the "about $40" level, which is this blog's opinion of the price.

Second, Mr. Hines does not provide a conclusive price for what new renewable energy will cost. Providing an average of bids is basically meaningless in describing future costs. One would expect, given that all bids are real, that the lowest cost bid would be the one selected by NorthWestern Energy. It is also likely that the high bid is probably for solar, which is unlikely to be built in Montana and would skew the price up. Given that NorthWestern Energy has just completed a Resource Procurment Plan that requires a detailed assessment of the cost of new renewables, i am curious as to why a more formal estimate for pricing was not provided (I suspect politics are afoot, and NWE's directors are aiming at the RPS).

Third, Mr. Hines claims that Mr. Brouwer's price for efficiency is wrong. I think that Mr. Brouwer and Mr. Hines are splitting hairs here, but it would be helpful to see some analysis from either party to support their estimate. Once again, Mr. Hines has a Resource Procurement Plan to reference. I would also note that the plan was delayed so NorthWestern Energy could complete a detailed study on the cost of energy efficiency.

Third Updated (11/3/2010), Here is the response i received from Mr. Brouwer which I have not verified, I have not received anything from Mr. Hines:

"The $4.80/MWh figure I used comes straight from testimony by Bill Thomas (NorthWestern Energy) in the recent PSC rate case (PDF page 8). I suspect the $12 figure they’re using is from a third party analysis of their DSM operations that they had done by Nexant in 2007. Unfortunately that report is three years old and doesn’t reflect the notable downward trend in DSM costs over the past few years."

NorthWestern Energy Clarifies Energy Supply Costs

NorthWestern Energy’s electricity supply costs, as represented by Ben Brouwer, the energy program manager for AERO, have been the subject of much recent debate. Since NorthWestern’s cost information is being used and debated, it is necessary to clarify and correct some of the data.

Mr. Brouwer’s analysis significantly underestimates both the cost of existing renewable resources and energy efficiency. Mr. Brouwer recently represented that the cost of energy from the Judith Gap Wind Farm is $29.00 a megawatt hour (MWh). That is not correct. There are several components to the Judith Gap contract and when all these costs are added together, NorthWestern customers are currently paying about $40/MWh, which changes slightly on a month-to-month basis. The Judith Gap contract was signed in 2004 and, since then, the cost of new renewable resources has increased.

NorthWestern is currently assembling additional renewable energy sources to meet the 2015 Renewable Portfolio Standard of 15%. In 2009, NorthWestern requested proposals from prospective renewable resource developers. We received 20 proposals with per megawatt hour costs ranging from $54 – 156.10 with a cost escalator or an average of $80.14. This information was provided to two Legislative Committees this past summer. In addition, NorthWestern Energy is obligated to purchase energy from small-scale renewable facilities (Qualifying Facilities) at a rate currently set at $69.21/MWh.

We agree with Mr. Brouwer that energy efficiency is a great resource for our customers. However, Mr. Brouwer’s analysis again misstates the actual cost of energy efficiency. NorthWestern is currently paying an average of $12/MWh for energy efficiency, nearly 2.5 times more than Mr. Brouwer’s number. This is a good deal for customers. We have ramped up our acquisition of efficiency and are now among the top tier nationwide. However, it is important to note that there is only a finite amount of cost-effective energy efficiency available to acquire.

NorthWestern believes customers benefit from a diverse portfolio of resources, including both renewable supply-side resources and energy efficiency. Energy policy is enhanced through discussion of the issues. An informed discussion must be based on the correct numbers.

Respectfully Submitted by

John Hines

Energy Supply Officer

NorthWestern Energy

40 E. Broadway

Butte, MT 59701

Idaho Power Proposes 25 year contract with Ridgeline Energy

This looks like an interesting project, and fairly good rates for Idaho Consumers. The project would be the first in the American Fall area. Ridgeline has developed several other projects in Idaho (including Wolverine and Goshen), but to my knowledge this would be the first that they would own. The project would lock in a 25 year flat rate of $71.29 per MWh.

Idaho Public Utilities Commission

Case No. IPC-E-10-24, Notice of Application and Comment Deadline

October 29, 2010

Contact: Gene Fadness (208) 334-0339, 890-2712

Utility seeks agreement with 80-megawatt wind project near American Falls

The Idaho Public Utilities Commission is taking comments through Nov. 19 on a request by Idaho Power Company to enter into a sales agreement with the 44-turbine, 80-megawatt Rockland Wind project near American Falls in eastern Idaho.

The agreement, with Seattle-based Ridgeline Energy, is for a PURPA project with a scheduled operation date of Dec. 31, 2011. PURPA is the federal Public Utility Regulatory Policies Act passed by Congress during the energy crisis of the late 1970s. The act requires electric utilities to offer to buy power produced by small power producers or cogenerators who obtain Qualifying Facility (QF) status.

The proposed agreement has many unique characteristics because of its size. All Idaho Power PURPA wind projects to date are 10 megawatts or smaller, which is as large as a project can be for developers to be paid an “avoided cost” rate that is determined and published by the commission. The avoided cost rate is to be equal to the cost the electric utility avoids if it would have had to generate the power itself or purchase it from another source. However, projects larger than 10 MW can still qualify as PURPA projects if the developer and the utility are able to negotiate a price that closely matches the utility’s avoided cost. Because Idaho Power customers ultimately pay for the power generated by PURPA projects, it is not in the public interest for the commission to approve sales agreements that result in customers paying more for power that could have been generated or purchased elsewhere at lower cost.

The negotiated levelized energy price in the 25-year agreement is $71.29 per megawatt-hour, according to Idaho Power’s application, lower than the published avoided cost rate of $75.88 per MWh for projects 10 MW or smaller.

The proposed agreement contains financial damage and security provisions for the benefit of customers in the event of the project’s default or failure to meet its completion date as well as a mechanical availability guarantee. The developer would retain the renewable energy credits (green tags) for the first 10 years, which will help offset the development cost. Idaho Power would keep the renewable energy credits for the final 15 years when the utility may have to comply with federal or state renewable portfolio standards.

The commission plans to handle this request in a modified procedure that uses written comments rather than conducting a hearing. Comments are accepted via e-mail by accessing the commission’s homepage at www.puc.idaho.gov and clicking on "Comments & Questions About a Case." Fill in the case number (IPC-E-10-24) and enter your comments. Comments can also be mailed to P.O. Box 83720, Boise, ID 83720-0074 or faxed to (208) 334-3762.

A full text of the commission’s order, along with other documents related to this case, is available on the commission’s Web site. Click on “File Room” and then on “Electric Cases” and scroll down to the above case number.

Thursday, October 28, 2010

Travis Kavulla: Please Stop Lying

Travis,

Consider this an open letter. In a few days you very well may be elected to the Montana Public Service Commission, and in that capacity you will have to take the following Oath:

"I do solemnly swear (or affirm) that I will support, protect and defend the constitution of the United States, and the constitution of the state of Montana, and that I will discharge the duties of my office with fidelity (so help me God)."

As an individual I am excited to see someone as young as you, and with a strong hunger for truly understanding the issues of the day, get involved in public service. But as an elected official, and what the Oath speaks to (especially the part about fidelity), is that you have an obligation to be honest and to not purposefully and maliciously distort the truth to fit your political needs.

So, please stop. Your editorial yesterday in the Great Falls Tribune is a pathetic work of fiction. Typically, I would dismiss it as just some person picking numbers to fit political needs. But you know better. You went to Harvard. You know as well as I do, that NorthWestern Energy is not going to pay the "average price per MWh" from it's RFI, and that they have selected a group of finalist with expected cost of around $65 MWh. Not the $80.14 as you allude to. I know that you know this because you quoted the relevant PSC docket in your TV ad.

You also know, that given the "historical levelized price of Mid-C" of $54 per MWh, that locking in $65 per MWh for a small portion (5%) might be a good deal and an effective way to minimize some of the high price risk of Mid-C.

If you don't like mandates and that is your beef with the RPS, ok. But than suggest some progressive ways that regulators can help to influence energy procurement decisions in Montana, instead of just massaging numbers and the narrative to meet your political needs. If you need some suggestions, or want to better understand these issues, please send me an email mtroscoe [at] gmail.com.

Fidelity Travis, fidelity.

Update: Travis' Response 11/1/2010

Dear Roscoe --

I've said it before and, despite your PSC coverage, I will say it again: Thank you for starting an energy blog. I can tell from reading the posts which do not concern me that we probably have a number of mutual sympathies, our differences notwithstanding.

First things first, I consider my Tribune piece considerably more factual than Mr. Brouwer's, with realization that we are both speculating about the possible future prices of electric power. The logic of my argument hinges on my use of an average deduced from a list of renewable proposals, as you note. I do not consider an average number unfair. Considering that the lowest-cost renewable proposals are also likely to be the largest facilities with the largest footprint -- just the type to be ripe for a NIMBY kibosh these days -- I consider it prudent to weight toward an average. Moreover, the number Mr. Brouwer has chosen as the stand-in for coal-fired generation is on the high end of the cost spectrum.

If you object to $80, how about we just call it fair at $71 per MWH, like the 80 MW-sized facility approved by Idaho's PUC? That is the likelier direction of wind development, and still significantly higher than the levelized Mid-C price or even a multicycle natural gas facility, supposing the glut of gas continues because of shale finds. Of course even that price does not accurately represent the additional value (or, in wind's case, lack of value) deriving from sales of excess electricity on the market. Wind is notoriously difficult to sell, and this diminishes its value in a way which is often not quantified.

Anyways, I think you misconstrue my point. I'm not against wind development. There clearly are projects which are feasible. Judith Gap appears to be one of these--and it would have been developed regardless of a mandate (a point of fact with which those mining it for figures do not grapple).

My problem is with the RPS. I have yet to hear any explanation of why a mandate makes sense, or why expanding the mandate would be a good deal for consumers. Instead, I hear the fallacy parroted over and over that wind is simultaneously a good deal economically, but that government needs to muscle you into this "good deal." When challenged on this apparent contradiction, the only response is something a la Mark Jacobson's vague prognostication that there are "market barriers that prevent renewable energy from competing on a fair basis," which is not followed by an attempt to explain any of them. I am merely looking for a credible and detailed explanation of what these barriers between a utility and low-cost electricity would be.

Nor am I denying that wind development here has something to do with West Coast mandates, with the federal renewable production tax credit, with utilities' own anticipation of Congressional and regulatory reform. But what man does can be undone. Tomorrow, California voters will be asked whether they will suspend the Calif. Renewable Portfolio Standard. The production tax credit is also scheduled to expire next year, unless Congress renews it. (On behalf of economic development in the Rocky Mountain states, I implore California voters to take the advice of the Sierra Club and continue to subject themselves to this onerous mandate.) The question is: Will the bottom fall out of renewable development?

I suppose I just don’t see why Montana — with a consumer base about 1/50th the size of California — should have to take the plunge when its commodities/resources competitors (North Dakota, Wyoming) are not. Especially when I'm a candidate for an office whose only historical purpose is to keep costs as low as possible without bankrupting the utility or stifling investment, I find it pretty rich that I'd be asked to endorse a mandate -- the sole purpose of which is to compel wind production even if it is not price-competitive. The fact that Wyoming has more MWs of wind development today even without a WY mandate should be evidence enough that an escalated RPS in Montana would be a needless act.

Anyways, I'd love to meet up for dinner or something in that netherworld of time before I take office -- should, of course, I have the good fortune to be elected by the people of PSC District #1. In spite of my politics, a good deal of my friends are liberals and I'm sure we will get along.

Feel free to reprint the above on your blog.

Sincerely,

Travis Kavulla

Consider this an open letter. In a few days you very well may be elected to the Montana Public Service Commission, and in that capacity you will have to take the following Oath:

"I do solemnly swear (or affirm) that I will support, protect and defend the constitution of the United States, and the constitution of the state of Montana, and that I will discharge the duties of my office with fidelity (so help me God)."

As an individual I am excited to see someone as young as you, and with a strong hunger for truly understanding the issues of the day, get involved in public service. But as an elected official, and what the Oath speaks to (especially the part about fidelity), is that you have an obligation to be honest and to not purposefully and maliciously distort the truth to fit your political needs.

So, please stop. Your editorial yesterday in the Great Falls Tribune is a pathetic work of fiction. Typically, I would dismiss it as just some person picking numbers to fit political needs. But you know better. You went to Harvard. You know as well as I do, that NorthWestern Energy is not going to pay the "average price per MWh" from it's RFI, and that they have selected a group of finalist with expected cost of around $65 MWh. Not the $80.14 as you allude to. I know that you know this because you quoted the relevant PSC docket in your TV ad.

You also know, that given the "historical levelized price of Mid-C" of $54 per MWh, that locking in $65 per MWh for a small portion (5%) might be a good deal and an effective way to minimize some of the high price risk of Mid-C.

If you don't like mandates and that is your beef with the RPS, ok. But than suggest some progressive ways that regulators can help to influence energy procurement decisions in Montana, instead of just massaging numbers and the narrative to meet your political needs. If you need some suggestions, or want to better understand these issues, please send me an email mtroscoe [at] gmail.com.

Fidelity Travis, fidelity.

Update: Travis' Response 11/1/2010

Dear Roscoe --

I've said it before and, despite your PSC coverage, I will say it again: Thank you for starting an energy blog. I can tell from reading the posts which do not concern me that we probably have a number of mutual sympathies, our differences notwithstanding.

First things first, I consider my Tribune piece considerably more factual than Mr. Brouwer's, with realization that we are both speculating about the possible future prices of electric power. The logic of my argument hinges on my use of an average deduced from a list of renewable proposals, as you note. I do not consider an average number unfair. Considering that the lowest-cost renewable proposals are also likely to be the largest facilities with the largest footprint -- just the type to be ripe for a NIMBY kibosh these days -- I consider it prudent to weight toward an average. Moreover, the number Mr. Brouwer has chosen as the stand-in for coal-fired generation is on the high end of the cost spectrum.

If you object to $80, how about we just call it fair at $71 per MWH, like the 80 MW-sized facility approved by Idaho's PUC? That is the likelier direction of wind development, and still significantly higher than the levelized Mid-C price or even a multicycle natural gas facility, supposing the glut of gas continues because of shale finds. Of course even that price does not accurately represent the additional value (or, in wind's case, lack of value) deriving from sales of excess electricity on the market. Wind is notoriously difficult to sell, and this diminishes its value in a way which is often not quantified.

Anyways, I think you misconstrue my point. I'm not against wind development. There clearly are projects which are feasible. Judith Gap appears to be one of these--and it would have been developed regardless of a mandate (a point of fact with which those mining it for figures do not grapple).

My problem is with the RPS. I have yet to hear any explanation of why a mandate makes sense, or why expanding the mandate would be a good deal for consumers. Instead, I hear the fallacy parroted over and over that wind is simultaneously a good deal economically, but that government needs to muscle you into this "good deal." When challenged on this apparent contradiction, the only response is something a la Mark Jacobson's vague prognostication that there are "market barriers that prevent renewable energy from competing on a fair basis," which is not followed by an attempt to explain any of them. I am merely looking for a credible and detailed explanation of what these barriers between a utility and low-cost electricity would be.

Nor am I denying that wind development here has something to do with West Coast mandates, with the federal renewable production tax credit, with utilities' own anticipation of Congressional and regulatory reform. But what man does can be undone. Tomorrow, California voters will be asked whether they will suspend the Calif. Renewable Portfolio Standard. The production tax credit is also scheduled to expire next year, unless Congress renews it. (On behalf of economic development in the Rocky Mountain states, I implore California voters to take the advice of the Sierra Club and continue to subject themselves to this onerous mandate.) The question is: Will the bottom fall out of renewable development?

I suppose I just don’t see why Montana — with a consumer base about 1/50th the size of California — should have to take the plunge when its commodities/resources competitors (North Dakota, Wyoming) are not. Especially when I'm a candidate for an office whose only historical purpose is to keep costs as low as possible without bankrupting the utility or stifling investment, I find it pretty rich that I'd be asked to endorse a mandate -- the sole purpose of which is to compel wind production even if it is not price-competitive. The fact that Wyoming has more MWs of wind development today even without a WY mandate should be evidence enough that an escalated RPS in Montana would be a needless act.

Anyways, I'd love to meet up for dinner or something in that netherworld of time before I take office -- should, of course, I have the good fortune to be elected by the people of PSC District #1. In spite of my politics, a good deal of my friends are liberals and I'm sure we will get along.

Feel free to reprint the above on your blog.

Sincerely,

Travis Kavulla

Tuesday, October 26, 2010

A Month In

It has been about a month since the first post, and I am excited about the attention the work has been getting. I hope that the 40 or so folks who read the blog daily will help to make it a little bit more dynamic by telling your friend and colleagues about it, and by commenting, and more importantly challenging and correcting the work.

If anyone has any tips or feedback, please contact me at mtroscoe@gmail.com.

Thanks for visiting!

Inverted Block Rates, the MCC, and why you should care

The Montana Public Service Commission (MT PSC) is currently reviewing a rate case by NorthWestern Energy that broadly addresses how Montanans are charged for the energy they consume. Though much of the focus of the docket has been on the actual increases NorthWestern Energy has proposed, there are two other important proposals that are being addressed in the docket: Decoupling and Inverted Block Rates.

Inverted Block Rates would fundamentally change the way customers are billed for electricity and natural gas. Under NorthWestern Energy's proposal (p. 24), residential customers would be split into two groups referred to here as low and high. The low group, under NorthWestern Energy's initial proposal, would consist of all customers that consume 0-350 kWh a month, and the high group would be those that consume greater than 350 kWh (there would be a similar design on the natural gas side). Each group would be charged a different price on an incremental basis for the energy that they consume. For instance, a consumer in the low group may have a rate of 4 cents/kWh, and the high group may be 6 cents/kWh.

The reason for separating the rates is to create a clear incentive for consumers to use less energy. Energy conservation benefits all consumers, by delaying the need to construct expensive new power plants and new transmission lines, and generally reducing prices as demand falls and less expensive forms of energy can be used.

To illustrate the incentives created by Inverted Block Rates, take the following example. Consumer A uses 350 kWh and Consumer B use 400 kWh. Consumer A would pay $14 per month, and Consumer B would pay $24. Consumer B would have an incentive of $10 per month, or $120 per year, to lower their electrical usage by 50 kWh per month.

The MT PSC is still deliberating how they will act on NorthWestern Energy's proposal, but in a series of filings in the docket most of the groups involved are in favor of the proposal, but with one notable exception: the Montana Consumer Council (MCC).

The MCC has filed their post hearing testimony earlier this week, which highlights their opposition (p. 5). I have immense respect for MCC's criticism of the economics of Inverted Block Rates, however i am not convinced that they come by the honestly. It seams to me that regardless of the proposal, the MCC just has a philosophical disagreement with the idea. I found the particular section telling:

"Some residential customers who require relatively large amounts of electric energy because they have electrically heated homes or large families will find their electricity bills rising by as much as 20 percent because of inverted block rates, while smaller consumers are afforded much smaller rate increases." (p. 11)

There are of course a lot more significant reasons why customers would have use more energy than just the number of family members. I would suspect that individual income, or house size, are more relevant indicators. And, in the case of electric heat, the Inverted Block Rate applies on both the electric and natural gas side, so customers who many not capture the lower rates on the electric side would capture them on the natural gas side. It seams to me that the MCC is missing its objective on representing all consumers, to protect the largest consumers of energy in Montana. Such as this 120,000 square foot home built by Tim Blixseth.

Of course, MCC is your representative in the case (they are an organ of the Montana Legislature).

As a final note, i will add that Professor Tom Power is strongly supporting NorthWestern Energy's proposal.

Inverted Block Rates would fundamentally change the way customers are billed for electricity and natural gas. Under NorthWestern Energy's proposal (p. 24), residential customers would be split into two groups referred to here as low and high. The low group, under NorthWestern Energy's initial proposal, would consist of all customers that consume 0-350 kWh a month, and the high group would be those that consume greater than 350 kWh (there would be a similar design on the natural gas side). Each group would be charged a different price on an incremental basis for the energy that they consume. For instance, a consumer in the low group may have a rate of 4 cents/kWh, and the high group may be 6 cents/kWh.

The reason for separating the rates is to create a clear incentive for consumers to use less energy. Energy conservation benefits all consumers, by delaying the need to construct expensive new power plants and new transmission lines, and generally reducing prices as demand falls and less expensive forms of energy can be used.

To illustrate the incentives created by Inverted Block Rates, take the following example. Consumer A uses 350 kWh and Consumer B use 400 kWh. Consumer A would pay $14 per month, and Consumer B would pay $24. Consumer B would have an incentive of $10 per month, or $120 per year, to lower their electrical usage by 50 kWh per month.

The MT PSC is still deliberating how they will act on NorthWestern Energy's proposal, but in a series of filings in the docket most of the groups involved are in favor of the proposal, but with one notable exception: the Montana Consumer Council (MCC).

The MCC has filed their post hearing testimony earlier this week, which highlights their opposition (p. 5). I have immense respect for MCC's criticism of the economics of Inverted Block Rates, however i am not convinced that they come by the honestly. It seams to me that regardless of the proposal, the MCC just has a philosophical disagreement with the idea. I found the particular section telling:

"Some residential customers who require relatively large amounts of electric energy because they have electrically heated homes or large families will find their electricity bills rising by as much as 20 percent because of inverted block rates, while smaller consumers are afforded much smaller rate increases." (p. 11)

There are of course a lot more significant reasons why customers would have use more energy than just the number of family members. I would suspect that individual income, or house size, are more relevant indicators. And, in the case of electric heat, the Inverted Block Rate applies on both the electric and natural gas side, so customers who many not capture the lower rates on the electric side would capture them on the natural gas side. It seams to me that the MCC is missing its objective on representing all consumers, to protect the largest consumers of energy in Montana. Such as this 120,000 square foot home built by Tim Blixseth.

Of course, MCC is your representative in the case (they are an organ of the Montana Legislature).

As a final note, i will add that Professor Tom Power is strongly supporting NorthWestern Energy's proposal.

Monday, October 25, 2010

Oregon Regulators concur with shutting down Coal Plants

Staff of the Oregon Public Utilities Commission has concurred with Portland General Electric's (PGE) request to close their Boardman Coal fired generation facility. PGE proposed shutting down Boardman in its 2009 Integrated Resource Plan, which must be approved by Oregon regulators. Boardman is a 550 MW coal plant, and the last such facility in Oregon.

The decision to close Boardman, appears to be based primarily on economic rational with the plant requiring significant investments in pollution control technology to keep operating. However, it is also part of a regional trend to retire 1970s era Coal fired generation. Puget Sound Energy suggested in their 2009 IRP that they would retire their interest in Colstrip units 1&2 in 2019 (p. 13).

The decision to close Boardman, appears to be based primarily on economic rational with the plant requiring significant investments in pollution control technology to keep operating. However, it is also part of a regional trend to retire 1970s era Coal fired generation. Puget Sound Energy suggested in their 2009 IRP that they would retire their interest in Colstrip units 1&2 in 2019 (p. 13).

Sunday, October 24, 2010

The Future Cost of Electricity in Montana

Travis Kavulla has tweaked his arguments against the Montana RPS, and is acknowledging that the RPS has not increased rates for Montana to date, but is poised to do so in the near future. And in doing so, Travis has highlighted an important question, what will different forms of energy cost in the future?

One of the undisputed benefits of wind, or renewables, is that they allow utilities and customers to lock in rates at construction. Unlike fossil fuels, the price of wind does not depend on the variable cost of fossil fuels.

Travis Kavulla has claimed that the next generation of wind will cost $69 per MWh, which is NorthWestern Energy's avoided cost rate. I think that the avoided cost rate is actually a poor proxy for future wind costs, and that actual rates will be around $55 per MWh (depending mostly on the cost of integration), but these are small details.

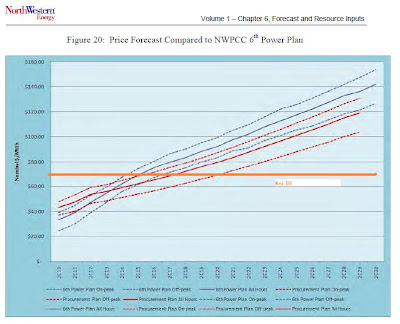

The real point is that even at $69 per MWh, Montana consumers have a fairly good deal on their hands. Why? Energy prices are projected to increase. Below is a figure from NorthWestern Energy 2009 Resource Procurement Plan, Page 119 of Chapter 6, that shows several projections for future market prices of electricity. I have added an orange line to show where the $69 per MWh wind cost falls out. The obvious implication is that wind offers Montanan's the opportunity to lock in low and reasonable prices for a portion of the electricity we consume (not necessarily all of it), but enough to hedge against future predicted price increases and volatility.

One of the undisputed benefits of wind, or renewables, is that they allow utilities and customers to lock in rates at construction. Unlike fossil fuels, the price of wind does not depend on the variable cost of fossil fuels.

Travis Kavulla has claimed that the next generation of wind will cost $69 per MWh, which is NorthWestern Energy's avoided cost rate. I think that the avoided cost rate is actually a poor proxy for future wind costs, and that actual rates will be around $55 per MWh (depending mostly on the cost of integration), but these are small details.

The real point is that even at $69 per MWh, Montana consumers have a fairly good deal on their hands. Why? Energy prices are projected to increase. Below is a figure from NorthWestern Energy 2009 Resource Procurement Plan, Page 119 of Chapter 6, that shows several projections for future market prices of electricity. I have added an orange line to show where the $69 per MWh wind cost falls out. The obvious implication is that wind offers Montanan's the opportunity to lock in low and reasonable prices for a portion of the electricity we consume (not necessarily all of it), but enough to hedge against future predicted price increases and volatility.

Friday, October 22, 2010

Excellent Commentary on Montana Energy Prices

Ben Brouwer with AERO, hits the nail on the head in his op-ed that ran in the Missoulian yesterday, on the relative cost of energy for Montanans. As I have already talked about these costs here before, I wanted to take the analysis one step further and calculate the welfare savings to Montanans.

Basically, how much has Judith Gap and the MT RPS saved Montana Consumers. For simplicity sake, I will just compare the plant to Colstrip 4.

450,000 (Judith Gaps approximate annual generation) * 18 ($/MWh savings for Judith Gap) * 4.5 (length of time Judith Gap has been online, years) = $36,450,000

That's right, the Montana RPS has saved Montana Consumers approximately $36 million.

It would of course be more accurate to compare the price of Judith Gap to the hourly market prices that NorthWestern Energy has paid, but these prices are not nearly as constant as Colstrip 4 and require more time than I have to determine.

Basically, how much has Judith Gap and the MT RPS saved Montana Consumers. For simplicity sake, I will just compare the plant to Colstrip 4.

450,000 (Judith Gaps approximate annual generation) * 18 ($/MWh savings for Judith Gap) * 4.5 (length of time Judith Gap has been online, years) = $36,450,000

That's right, the Montana RPS has saved Montana Consumers approximately $36 million.

It would of course be more accurate to compare the price of Judith Gap to the hourly market prices that NorthWestern Energy has paid, but these prices are not nearly as constant as Colstrip 4 and require more time than I have to determine.

Monday, October 18, 2010

FERC will not rubber stamp NorthWestern Energy’s proposal on Mill Creek

In an Order issued Friday, FERC has found that NorthWestern Energy’s proposal was not “just and reasonable” and will grant only temporary acceptance until a full hearing can be held.

This is a big deal for Montana rate payers as FERC is committing to a rigorous analysis of NorthWestern Energy’s proposal. It will be interesting to see if any of the Montana media picks up the story, how this alters NorthWestern Energy’s filings with the MT PSC on the same subject, and to what degree it may impact expectations about company revenues. NorthWestern Energy has invested around $150 million into the plant, and any change by FERC or the MT PSC, on how NorthWestern Energy will recover costs could drastically alter their financial projects and bottom line.

The Order highlights a number of very substantive issues as to how Mill Creek will be operated that quickly dive off into energy wonk land. Suffice it to say, they are not taking anything NorthWestern Energy has proposed on face value.

Sunday, October 17, 2010

HJR-7, and its big implications for Idaho

The Idaho Post Register has a fantastic piece today on this complex initatives that would rewrite how municipal power providers in the state contract for power. Under current rules, municipal power providers (such as Idaho Falls Power), must seek approval from members through an election before entering into long-term contracts. The politics here are fascinating, take this statement from the Chair of the Bonneville County Republicans.

Don Schanz, chairman of the Bonneville County Republican Central Committee, holds a more nuanced view of the proposed amendment. While the Republican Committee has yet to take a position on the proposed amendment, Schanz said it's his personal opinion that Idaho Falls and other power cities should be able to enter power contracts they deem in the best interests of the city.

"That's what you hire bureaucrats for," he said.

As the Post Register explains, long-term contracting capacity is critical for gaining access to low-cost power at opportune times without the expense and time lags of elections. Without the authority, municipal power providers could find themselves at a disadvantage to the states large IOUs that have this privilege and forced to resort to short-term contract positions, which could mean higher rates for Idaho consumers.

Compare this to Montana, where there is no approval process for long-term contracts by members or customers of either IOUs or cooperatives.

Don Schanz, chairman of the Bonneville County Republican Central Committee, holds a more nuanced view of the proposed amendment. While the Republican Committee has yet to take a position on the proposed amendment, Schanz said it's his personal opinion that Idaho Falls and other power cities should be able to enter power contracts they deem in the best interests of the city.

"That's what you hire bureaucrats for," he said.

As the Post Register explains, long-term contracting capacity is critical for gaining access to low-cost power at opportune times without the expense and time lags of elections. Without the authority, municipal power providers could find themselves at a disadvantage to the states large IOUs that have this privilege and forced to resort to short-term contract positions, which could mean higher rates for Idaho consumers.

Compare this to Montana, where there is no approval process for long-term contracts by members or customers of either IOUs or cooperatives.

Friday, October 15, 2010

ConocoPhillips Fined $69,400 for not complying with the MT RPS standard

The Order was signed yesterday by the commission, and follows almost a 9 month procedural investigation into compliance with the RPS by the PSC. The relevant PSC docket can be accessed here.

The primary issue for the PSC, was whether the ConocoPhillips Company met the requirements of a "competitive electric supplier" under the MT RPS standard. The PSC found that they did, as in 2008 they sold almost 138,812 MWh of energy to four industrial customers: Jupiter Sulphur, the Yellowstone Pipeline Company, the ConocoPhillips Pipeline Company, and Stimson Lumber. As Connco Phillips made little effort to procure 5% of these sales from a renewable source, the MT PSC charged them the applicable administrative penalty of $5.

That is equivalent to the amount energy consumed by about 12,500 Montana homes. The decision appears to be on the mark, and to my recollection the first time that the administrative penalty for the RPS has been applied.

The primary issue for the PSC, was whether the ConocoPhillips Company met the requirements of a "competitive electric supplier" under the MT RPS standard. The PSC found that they did, as in 2008 they sold almost 138,812 MWh of energy to four industrial customers: Jupiter Sulphur, the Yellowstone Pipeline Company, the ConocoPhillips Pipeline Company, and Stimson Lumber. As Connco Phillips made little effort to procure 5% of these sales from a renewable source, the MT PSC charged them the applicable administrative penalty of $5.

That is equivalent to the amount energy consumed by about 12,500 Montana homes. The decision appears to be on the mark, and to my recollection the first time that the administrative penalty for the RPS has been applied.

Wednesday, October 13, 2010

"It will literally suck all the energy out of Montana"

MSTI, the Mountain States Transmission Intertie that is, and Bill Gallagher who is challenging incumbent Ken Toole, is against it. Now, I think there are lots of real arguments against MSTI, but this is just hyberbole that is so far removed from reality, that Bill Gallagher is making the could be chair of the Montana Public Service Commission Brad Molnar look, and i hate to say this, rational.

The quote is from Emily Ritter's Montana Public Radio feature interview last night of both Toole and Gallagher, and comes in the context of Mr. Gallagher's concern that MSTI will raise rates for Montanans.

For those of us that are familiar with the physics of the Montana electrical grid, it is clear that MSTI will not suck all the energy out of Montana. Here is why:

Mr. Gallagher is also concerned that Californians will be able to bid against Montanan's for this energy. This is also impossible, as MSTI stops in southern Idaho. From there, there is little or effectively no capacity to move power to California. Which means, if anything, Montanans would be competing with Idaho for our energy and that may be a good thing for Montana as Idaho pays less on average for energy than we do in Montana (keep in mind power can flow both ways on electrical transmission).

Idaho: $56.9 per MWh

Montana: $77.2 per MWh

Moving forward, I actually think the market impacts to Montanans from new transmission are really important and need more substantive analysis. As a first step, maybe those running for elected offices could commit to doing just that.

The quote is from Emily Ritter's Montana Public Radio feature interview last night of both Toole and Gallagher, and comes in the context of Mr. Gallagher's concern that MSTI will raise rates for Montanans.

For those of us that are familiar with the physics of the Montana electrical grid, it is clear that MSTI will not suck all the energy out of Montana. Here is why:

- Montana has about 5500 MW of generation capacity

- MSTI only has a capacity of 1500 MW (From NWMT's website)

- 1500 is less than 5500 => MSTI can not suck all the energy out of Montana.

Mr. Gallagher is also concerned that Californians will be able to bid against Montanan's for this energy. This is also impossible, as MSTI stops in southern Idaho. From there, there is little or effectively no capacity to move power to California. Which means, if anything, Montanans would be competing with Idaho for our energy and that may be a good thing for Montana as Idaho pays less on average for energy than we do in Montana (keep in mind power can flow both ways on electrical transmission).

Idaho: $56.9 per MWh

Montana: $77.2 per MWh

Moving forward, I actually think the market impacts to Montanans from new transmission are really important and need more substantive analysis. As a first step, maybe those running for elected offices could commit to doing just that.

Tuesday, October 12, 2010

NrothWestern Energy has filed to include Mill Creek in the "rate base"

The full press release is available from NorthWestern Energy here. The links are still broken for the filings, but except some analysis once they are available, as i know a lot of folks are watching these rates closely to see what the cost will be to regulate wind and load in Montana and how NorthWestern Energy plans to operate the facility.

Here is how NorthWestern Energy is describing their request:

Butte, Mont. – Oct. 12, 2010 – NorthWestern Energy’s (NYSE:NWE) Mill Creek Generating Station will begin serving Montana electric customers by January 1, 2011, prompting the company to file an application to include it in energy supply rates on an interim basis until the actual revenue requirement is approved.

The 150-megawatt natural gas fired plant is the first newly constructed facility to be approved under the law which allows public utilities to obtain “preapproval” of electric generation resources prior to acquisition, or in this case, construction. The Montana Public Service Commission approved in part the preapproval application in May 2009 with the requirement that the company submit a compliance filing within 90 days after the plant is placed into commercial operation. The compliance filing will be used to determine the plant’s final revenue requirement.

Update: The AP is reporting that the request will increase rates for a consumer by $4.5 a month.

Here is how NorthWestern Energy is describing their request:

Butte, Mont. – Oct. 12, 2010 – NorthWestern Energy’s (NYSE:NWE) Mill Creek Generating Station will begin serving Montana electric customers by January 1, 2011, prompting the company to file an application to include it in energy supply rates on an interim basis until the actual revenue requirement is approved.

The 150-megawatt natural gas fired plant is the first newly constructed facility to be approved under the law which allows public utilities to obtain “preapproval” of electric generation resources prior to acquisition, or in this case, construction. The Montana Public Service Commission approved in part the preapproval application in May 2009 with the requirement that the company submit a compliance filing within 90 days after the plant is placed into commercial operation. The compliance filing will be used to determine the plant’s final revenue requirement.

Update: The AP is reporting that the request will increase rates for a consumer by $4.5 a month.

Monday, October 11, 2010

What does Judith Gap Actually Cost?

There seams to be some ambiguity about how much Judith Gap, which provide about 8% of NorthWestern Energy's annual needs, actually costs.

Mike Dennison, in his profile today about the PSC races, pegs it at between "$40 to $50 per megawatt hour, including power that balances intermittent wind power". Commissioner Toole says it is "$39.48 per MWH (this includes the cost of "regulating")", and Travis Kavulla thinks it costs "double the market price", which, at the least, is greater than $70 per MWh.

That's a pretty big spread and a big deal for Montanan's, as a change in $5 per MWh represents $2.25 million in value.

Fortunatley, every month NorthWestern Energy is required to file a Monthly Supply Tracker which shows the cost they are paying for each resource for that month, and its projected forward expenses for a year. Based on the lasted tracker, filed on 9/15/2010, NorthWestern Energy is projecting to pay $14,048,421 for an estimated 476,592 MWh from Judith Gap. Or, $29.48 per MWh.

Now, this price does not include the cost of integration or balancing. However, under guideline determined in previous dockets, NorthWestern Energy has assigned 91.23% of the cost of these services for all the wind plants on its system to Judith Gap (See NorthWestern Energy's response to MCC10, D2010.7.77) These costs are projected to be $3,857,145.80 for effectively the same time period as above. Which amounts to a cost of integration of $8.10.

Bottom line: Judith Gap $8.10 (integration) + $29.48 (energy) = $37.58 per MWh

Caveat to the above: NorthWestern Energy, in their 2009 Resource Procurement Plan, describes the tracker as not being inclusive of "payments or reimbursements to Invenergy under terms of the long-term purchase power agreement. These items include property taxes and impact fees" (p.2 Chapter 3) Given this statement, the tracker costs may need to be increased to cover property taxes from the facility (I would estimate around $1 million), and other soft costs. Given the inclusion of these costs, I would suspect Commissioner Toole is right on the money.

Mike Dennison, in his profile today about the PSC races, pegs it at between "$40 to $50 per megawatt hour, including power that balances intermittent wind power". Commissioner Toole says it is "$39.48 per MWH (this includes the cost of "regulating")", and Travis Kavulla thinks it costs "double the market price", which, at the least, is greater than $70 per MWh.

That's a pretty big spread and a big deal for Montanan's, as a change in $5 per MWh represents $2.25 million in value.

Fortunatley, every month NorthWestern Energy is required to file a Monthly Supply Tracker which shows the cost they are paying for each resource for that month, and its projected forward expenses for a year. Based on the lasted tracker, filed on 9/15/2010, NorthWestern Energy is projecting to pay $14,048,421 for an estimated 476,592 MWh from Judith Gap. Or, $29.48 per MWh.

Now, this price does not include the cost of integration or balancing. However, under guideline determined in previous dockets, NorthWestern Energy has assigned 91.23% of the cost of these services for all the wind plants on its system to Judith Gap (See NorthWestern Energy's response to MCC10, D2010.7.77) These costs are projected to be $3,857,145.80 for effectively the same time period as above. Which amounts to a cost of integration of $8.10.

Bottom line: Judith Gap $8.10 (integration) + $29.48 (energy) = $37.58 per MWh

Caveat to the above: NorthWestern Energy, in their 2009 Resource Procurement Plan, describes the tracker as not being inclusive of "payments or reimbursements to Invenergy under terms of the long-term purchase power agreement. These items include property taxes and impact fees" (p.2 Chapter 3) Given this statement, the tracker costs may need to be increased to cover property taxes from the facility (I would estimate around $1 million), and other soft costs. Given the inclusion of these costs, I would suspect Commissioner Toole is right on the money.

Sunday, October 10, 2010

Travis Kavulla's Attack Ad: false (Part II)

The blog got a lot of activity after the previous post about Travis Kavualla's attack ad, and i suspect that Travis' google alert has directed him to the site. So, now that i have your attention, let's get to the real meat of the problem with Travis' ad.

Your second claim, "And he voted to force your power company to spend double the market price to buy renewable energy or credits". First, I doubt this would survive a complaint to the Commission of Political Practices without even a date to reference Don Ryan's purported vote or the bill number. But for the purpose of argument, and please correct me if I am wrong, the reference was probably to the MT Renewable Portfolio standard (RPS) which mandates that regulated utilities (NorthWestern Energy, MDU, and apparently the City of Great Falls) purchase a portion of energy from renewable energy products.

Ok, so does the RPS standard require utilities to buy energy at double the market price? Travis offers two links, which i have pulled and posted for everyone's convince, that are apparently related to his claim.

1. http://ferc.gov/market-oversight/mkt-electric/northwest.asp (This link was slightly modified to work), referred to as "link 1"

2. http://www.psc.mt.gov/eDocs/eDocuments/pdfFiles/D2010-7-77IN10080634144TA.pdf , referred to as "link 2"